Please forgive the following brief mathematical interlude. It's been a long time since I came across the phrase "standard deviation" in everyday life.

Conventional wisdom has it that the more tolerance for risk that an investor has, the higher they can expect their investment returns will be over the long term. In practical terms, this means investors who gravitate towards things like bonds and GIC's trade off higher potential returns in exchange for safety, security, and -- let's face it -- peace of mind. Conversely, risker investors expert better returns for their efforts.

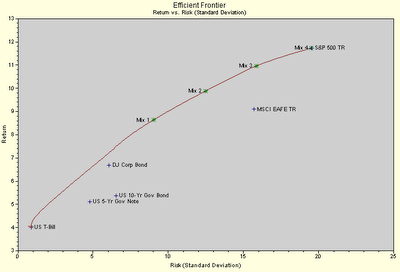

There's nothing particularily revolutionary about that concept, but it's important to remember that the relationship between risk and reward does not necessarily go in a straight line.

Generally speaking, adding acceptable amounts of risk -- investing in emerging markets or volatile small cap stocks, for example -- to a balanced portfolio does allow for the possibility of superior investment returns over the long term. But in real terms, it's not a linear relationship: more risk does not necessarily mean exponentially more reward.

If you could put a numerical value on the level of risk you're taking, then doubling it doesn't necessarily mean you can expect to double the reward, depending on how much your initial risk. This graphic sums up what I'm clumsily trying to say quite well.

My apologies for usurping the original intentions of the chart-maker but essentially, stock data from the last 80-odd years seems to suggest something I've always believed to be true myself: The relative gains to be had from increasing one's risk exposure tend to decrease the more risk you're taking on.

See how the curve flattens out the further to the right on the "risk" axis you get? In practical terms, that means the bump you'd take from moving money from a GIC, for example, into a diversified blue-chip equity fund is a lot more, in relative terms, than the one you get from moving from one volatile sector into an even risker one.

The lesson? As always, diversify.

And don't take on more risk than is worth your while.

Wednesday, November 29, 2006

Risk vs. Reward -- a rethink

Posted by

GIV

at

3:20 PM

![]()

Labels: asset allocation, investing

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment