Sat down this week to crunch some numbers I've been meaning to tabulate for a little while now.

Considering my relatively young age, I've had my toe dipped in the water of the investing pool for some time already, although I'd say I only truly got serious about investing in the last two years or so, once I finished school and got a real job with real money.

The biggest thing that inspired me to turn my investing style on its head and really start doing some homework before jumping into or out of a stock was the inspirational, educational and helpful stories I found out there on something called the pfblogosphere -- most of whom I'm pleased to say I stumbled across while sifting through pfblogs.org. Some of my favourites are linked on my sidebar to the right, but I really do find great new pfblogs on an almost daily basis -- far too many to list here.

Anyway, if it weren't for the lessons I learned through pfblogs, I would never have learned the magical power of value investing -- and perhaps more importantly, of the sheer majesty of dividends. The aforementioned number I crunched is my annual dividend and distribution income-- currently up to an impressive $697.83 per year.

I know it's not much to some people, but considering where I started from, that's an absolutely astounding number to me. Six hundred bucks is a lot of money. It's a sum that's even more amazing to me considering it's passive money. It just flows into my account, sometimes reinvested into more shares, but sometimes not, without me having to lift a finger or open an analyst report. And that doesn't even include the capital gains I've made this year.

I guess what I'm trying to say is, thanks.

I'm still early on my journey. But $697.83 is a nice reminder to me of why it pays to keep on my current path.

Thursday, December 21, 2006

I'm $697.83 richer thanks to pfblogs.org

Posted by

GIV

at

4:38 PM

2

comments

![]()

Friday, December 15, 2006

Free money? Good. Unexpected free money? Better

When I set up my automated savings program at ING Direct to automatically deduct a chunk of every paycheque back in September, I liked the idea mainly because it would force me to save. It wasn’t too difficult to get myself to live off of about 3/4 of my usual paycheque. And the balance would be socked away, working for me at a generous 3.5% rate, making my eventual downpayment on a house as big as it could be.

Sure, an added bonus was the possibility that I’d win one of the bank’s quarterly draws for $10,000, but I wasn’t really counting on it.

But when I checked my account today, there was great little bit of news for me:

11-Dec-2006 ASP Setup Bonus - $20

Apparently ING has been good enough to front me an extra $20, just for setting up the automated payment program. Sure it’s only 20 bucks, but it really brought a smile to my face. Especially since I didn’t know that was part of the deal when I set up the process.

What a great bank.

Posted by

GIV

at

11:06 AM

0

comments

![]()

Labels: ING Direct, saving

Tuesday, December 12, 2006

Mandatory retirement

I’m of two minds about the news that Ontario has moved to ban mandatory retirement of workers at age 65.

On the one hand, I support the move because the leftist in me thinks it’s wrong to discriminate against people for any reason. It’s wrong to deny someone an opportunity they deserve based on their race or gender, so why shouldn’t it be illegal to discriminate against that same person because of their age.

And on a more pragmatic level, I buy into the theory that the over-65 set are blessed with years of experience and knowledge that the Canadian economy can use to get better and more efficient. To an extent, anyway. On that level, forcing sharp-minded people out the door when they arbitrarily hit a certain age doesn’t make sense from an economic point of view.

But part of me doesn’t like this new law. As a young worker myself, I have first-hand experience that a glut of older workers hanging on to high-paying jobs when they’re clearly past their prime is a direct cause of why it’s so hard for a lot of young people to get their start. I think we’ve all worked at places that were top-heavy with older, unfireable workers who were clearly just mailing it in on a daily basis. My university faculty was full of them, for example. The best profs I had were under 40, but they all ended of leaving because the tenured profs above them blocked their access to the upper levels. Leaving aside the injustice of that, I think we all can agree that just as it’s foolish to cast off useful workers solely for age reasons, it’s likewise stupid to not allow innovative new thinkers into the economy.

Maybe this is just a tempest in a tea-pot anyway. The government’s own numbers estimate that only about 4,000 of the 100,000 Canadians who turn 65 every year will take advantage of this new law. I mean, most people I know would rather spend their retirement enjoying themselves than being a wage slave. So hopefully they’ll be more useful seniors who stick around than less productive ones, as most of the pundits are predicting, and the new law will be a net gain for everybody.

My dad, for example, semi-retired when he turned 60 largely for health reasons. He soon got bored with all the free time on his hands, so he now works part-time as a consultant in his industry. His income is about a third of what it was at his peak, but he likes his lifestyle, it keeps him busy for a few days out of every week, and his health is better too.

I don’t think he really did it for the money -- I’d ballpark my parents’ net worth at in excess of a million dollars. But I like his choice. He’s healthy, he enjoys his life, and he apparently still has a skill-set in demand in his industry.

If this new law makes more people like that, I’d guess it’s a good thing. But if it becomes another obstacle to getting healthy turnover in the Canadian economy, we’ll all be worse-off for it. Time will tell I suppose.

As always, I love hearing disagreeing viewpoints in the comments section.

Posted by

GIV

at

11:32 AM

1 comments

![]()

Labels: economy, retirement

Thursday, December 07, 2006

I hate fees -- and you should too

Yet another worthwhile issue of MoneySense magazine plunked into my mailbox this week. I highly recommend getting yourself a subscription -- it's easily the best $20 I ever spent for my personal finance education.

A highlight for me was Duncan Hood's column on page 16, entitled Do fees really matter?

It's not available online yet, I don't think, and while I highly recommend buying yourself a copy, I'm going to excerpt a particularly enlightening passage here because it provides mathematical ammunition for why investing fees are the surest, quickest way of eating into your investment returns.

If you invest $100,000 in a standard portfolio of stocks and bonds for 25 years, history suggests you might get an average return of 7%. At that rate, your money would grow to more than $540,000.

But taxes takes the first bite out of that.. If you keep you portfolio outside an RRSP and you earn $75,000 a year or more, you will end up paying taxes on your investment returns of at least 20%, reducing your rate of return to 5.5% a year and leaving you with a portfolio worth just under $400,000.

Once we factor in inflation, which has been running at about 2.5% a year, your return drops to 3%, leaving you with a portfolio worth $200,000 in today's dollars.

The average Canadian mutual fund charges 2.5% per year in fees. That won't take a full 2.5% off yoru returns as fees are deducted before taxes and inflation, but it will do some serious damage, Fees reduce your return to 1%, leaving a portfolio worth $130,000 in today's dollars

At the end of our experiment, the sample portfolio has been knocked down from 7% growth a year to 1% a year. That bleeds the hypothetical $540,000 portfolio into an actual $130,000 one.

$30,000 profit to show for a quarter-century of diligent, diversified investing?

Fees matter. Anything you can do to reduce the amount that is trickled out of your portfolio every year, do it. It all adds up.

If you're paying a financial advisor 2% of your money each and every year to buy you a Canadian index fund, stop. And say it with me: ETFs! ETFs ETFs!

Posted by

GIV

at

12:04 PM

0

comments

![]()

Wednesday, December 06, 2006

Biovail does it again

Holy Crap! Just when I'm thinking of dumping my Biovail shares since the company's growth prospects are so dim, they go and pull something like this:

Effective immediately, Biovail's Board of Directors has adopted a new dividend policy that contemplates the payment of an annual dividend of $1.50 per common share, a 200% increase relative to the Company's former policy.

In addition, the Company's Board of Directors has today declared the payment of a special cash dividend of $0.50 per share payable on January 22, 2007, to shareholders of record at the close of business on January 10, 2007.

Sweet! Beyond the extra cash, what really pleases me about this is that Biovail wouldn't have boosted the dividend unless they were confident they could maintain the payments. Only a complete gong-show of a company would up their dividend and then slash it shortly thereafter.

This way, I can enjoy the coveted double-whammy -- extra dividend money, coupled with steady capital gains as Mr. Market realizes that Biovail is now a decent income-producing equity. The Dividend Guy would be proud.

I still have no idea what Biovail is going to do on any given day, but considering the amount of nasty surprises I took during the first few years I held the shares, I'm happy to ride this current wave of pleasant surprises.

Posted by

GIV

at

10:47 AM

0

comments

![]()

Tuesday, December 05, 2006

The rich get richer

News in this morning's Globe about how the richest 2% of people in the world own more than half of the world's assets doesn't really come as much of a surprise to me, although some of the specific numbers did give me pause.

In the world's first ever exhaustive survey on the subject, the UN found that the gap between the super-rich and the desperately poor is indeed widening at an astonishing rate. Compared to their elite counterparts, for example, the poorest 50% of the world's population control less than 1% of the world's wealth. And the gulf has widened sharply over the last 50 years.

Some other findings:

- Assets of $2,200 (U.S., I presume) would place you among top half of the world's wealth distribution

- Assets of $61,000 would place you in the top 1%. That's just an astoundingly low threshold to me. Essentially, if you have a net worth of $61,000, you're among the richest 1% of people on earth

- The vast majority of the super-wealthy live in North America, Europe and the Pacific Rim.

Still wondering how you stack up? Check out this interactive How Rich are You? calculator to see where you rank among the world's wealthiest. It certainly provided some sobering food for thought to me this holiday season. Brings my little petty obsession with my own net worth calculator really into perspective.

Posted by

GIV

at

2:25 PM

0

comments

![]()

Labels: net worth

Monday, December 04, 2006

Carnival of Self-Indulgence

I must confess I've largely stopped paying attention to all the various personal-finance related carnivals out there (Carnival of Investing and Carnival of Personal Finance being the biggest) precisely because they've been too large and cumbersome to be useful.

They used to be small, manageable affairs that drew readers' attention to pertinent information they might have missed out there in the blogosphere. Particularly creative hosts would often weave different blog posts into a single narrative to really draw you in. Ones like this, in particular, were great in my opinion. I really did click and read every single entry, just because of the innovative way they were packaged to me.

But now? This is what the Carnival has devolved into.

No particular disrespect intended to David, as I think his offering is merely the latest, extreme example in the growing trend of what's happening to these things. I don't blame him for inventing a new revenue-generating idea for himself. But really -- embedding Google ads into the body of the Carnival's text to make them look like legitimate entries? He's being lauded in the comments section for his innovative and creative presentation ideas. But let's call a spade a spade here, people: the only reason this was done is to jack up the google adsense clicks on the site.

More power to him, or anyone else, who tries to squeeze a little extra income out of their blog. It figures that we financially-inclined pfbloggers would try industrious ideas like this to generate revenue. But as a reader, I don't have to like it.

I work in the dead-tree business. We have a word for when ads try to match their fonts and typeface with the newspaper's look to try to dupe people into thinking the content is legitimate. It's called advertorial, and most journalists -- and readers -- hate it. It benefits no one but the publisher's pocket.

I will continue to read carnivals of all varieties in the future, because there are always interesting things to extract from them. But strategies like this (coupled by the fact that a lot of the entries only seem to be tangentially-related to personal finance and are submitted by people just looking to bring more eyeballs to their page) take away from the Carnival's original intention: to foster a collaborative atmosphere by sharing personal financial knowledge to people who want and need some insight. Doing stuff like this makes it harder and harder to mine the carnival's for useful and interesting personal finance advice and writing.

Indeed, I'm sure I'll even submit once in a while when I feel I have something useful to add to the discussion. But I just don't think tactics like this one are something that needs to be encouraged. In short, I don't like what's become of the Carnival I onced enjoyed so thoroughly.

Posted by

GIV

at

11:23 AM

0

comments

![]()

Labels: Carnivals

Friday, December 01, 2006

How much blogger does $25,465 get you these days?

Apparently, this much.

Just a note to say I've started one of those handy NetworthIQ graphics on the sidebar of this page to help me track my long-term progress.

After entering my data, I see I'm currently worth $25,465 -- a 1.77% increase from last month.

Let's hope that little line keeps pointing up.

Posted by

GIV

at

4:03 PM

3

comments

![]()

Labels: net worth

Thursday, November 30, 2006

Should I open my own coffee shop, or just flush $20 bills down the toilet for the next few years?

I found a fantastic article on slate.com today which pokes holes in every faux artistic type's fantasy business -- owning their own quaint little neighbourhood coffee shop.

I have the utmost respect for entrepreneurs. It's a mindset that I sadly just don't have, but one I admire immensely in others. Owning your own business is a brave thing to do no matter what you're selling. But as the article points out, with low profit margins, a hectic workload and high costs, a coffee shop might be the worst or all. Yet, so many people are lulled into the romantic mystique of a quiet, satisfying life as a coffee-shop owner.

Not that I ever flirted with the idea of opening one myself, but I do fondly recall wiling away the hours during my unversity days, sipping back cappucino's and chai teas in the popular independent coffee shop just off campus. I'd go in mid-morning, grab a $1.20 medium coffee and nurse it for an hour while I read and waited for class. Then I'd come back in the afternoon and relax for a few hours with new-found friends until dinner with a $2 chai latte.

Imagine my surprise when the place went bankrupt just a few months later. Apparently it's hard to make a profit off of notoriously poor and stingy university students when they sit in your business for an average of 2 hours a day, taking up seats other people might have used, all in exchange for about $3.

My favourite part of the article:

The house brew too cold to be sold for $1 a cup was chilled further and reborn at $2.50 a cup as iced coffee, a drink whose appeal I do not even pretend to grasp.

Sounds very familiar. Top-notch writing once again from Slate magazine.

Posted by

GIV

at

2:20 PM

1 comments

![]()

Labels: entrepreneurs

Wednesday, November 29, 2006

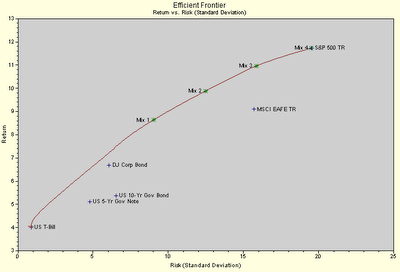

Risk vs. Reward -- a rethink

Please forgive the following brief mathematical interlude. It's been a long time since I came across the phrase "standard deviation" in everyday life.

Conventional wisdom has it that the more tolerance for risk that an investor has, the higher they can expect their investment returns will be over the long term. In practical terms, this means investors who gravitate towards things like bonds and GIC's trade off higher potential returns in exchange for safety, security, and -- let's face it -- peace of mind. Conversely, risker investors expert better returns for their efforts.

There's nothing particularily revolutionary about that concept, but it's important to remember that the relationship between risk and reward does not necessarily go in a straight line.

Generally speaking, adding acceptable amounts of risk -- investing in emerging markets or volatile small cap stocks, for example -- to a balanced portfolio does allow for the possibility of superior investment returns over the long term. But in real terms, it's not a linear relationship: more risk does not necessarily mean exponentially more reward.

If you could put a numerical value on the level of risk you're taking, then doubling it doesn't necessarily mean you can expect to double the reward, depending on how much your initial risk. This graphic sums up what I'm clumsily trying to say quite well.

My apologies for usurping the original intentions of the chart-maker but essentially, stock data from the last 80-odd years seems to suggest something I've always believed to be true myself: The relative gains to be had from increasing one's risk exposure tend to decrease the more risk you're taking on.

See how the curve flattens out the further to the right on the "risk" axis you get? In practical terms, that means the bump you'd take from moving money from a GIC, for example, into a diversified blue-chip equity fund is a lot more, in relative terms, than the one you get from moving from one volatile sector into an even risker one.

The lesson? As always, diversify.

And don't take on more risk than is worth your while.

Posted by

GIV

at

3:20 PM

0

comments

![]()

Labels: asset allocation, investing

Wednesday, November 22, 2006

How I got my bank to pay me to fly to California

Alternate title -- Growth in Value's credit card experiment

After being bombarded by all the offers for new credit cards that my bank seems to send me on a quarterly basis (it's amazing what paying off your bill every time in full can do for your reputation) a few months ago I finally caved in and signed up for one of RBC's annual-fee cards.

I know, I know -- I can hear you all saying, "What? I can't believe it -- after the way he blathers about low-fee investing on his blog, he has the audacity to get suckered into paying for a credit card when there are so many free ones available."

I get it. But hear me out. While it's true that I have experienced a small amount of buyer's remorse after seeing the sweet deals that places like PC Financial and CIBC are offering (free groceries and cash back on purchases sound pretty damn tempting to me) I didn't just blindly go into this. I figured out, based on how much I was putting on my card in an average month, added to the bonus points I was being offered for singing up, I could get myself a free flight out of it.

Here's my plan:

I signed up for RBC's Platinum Avion card. It comes with all the usual accoutrements these cards tend to have -- deals on extended warranties, rental car insurance, traveler's cheques and insurance, etc. -- for a pricey (to me anyway) annual fee of $120. They gave me 10,000 points just for signing up, and 5,000 more points when I renew after the first year. So right off the bat, I'm at 15,000 RBC Rewards points even if I don't put a penny on the card for two years.

On my old, no-annual-fee card, I used to rack up a few hundred dollars a month, largely on purchases from retailers and online purchases. I think my most expensive month ever was about $500, and I had months of well under $100. The average was probably between $200 and $300 a month.

For my new plan to work, I need to start putting more money on the card to rack up points -- with the important caveat being that I'm not actually spending any more money than I would otherwise have spent through other means like cash and debit cards, because that would obviously negate any "savings" from points I was accruing.

Keeping in mind that I always pay off 100% of my bill on-time, I figured, if i start putting things like restaurant bills, groceries and gasoline on the card -- stuff I used to pay cash for -- I'd quickly rack up the points to get some sweet rewards. And it wouldn't actually be costing me any more in real dollar terms, since those are all items I'd be paying for anyway.

I've been doing this for six months so far, and my theory appears to be working. I haven't had a bill yet that was under $500, and I'm knocking on $1000 a month more often than not. It's amazing how much groceries you can buy!

So let's make a conservative estimate and say I'm putting an average of $700 a month on my new card. After two years, at 1 point per dollar, this means I will have accrued 18,000 points -- bringing my total to something in the neighbourhood of 33,000 points.

What does that do for me? According to the handy chart they provide, 30,000 points earns me a flight anywhere in continental North America. So essentially, for $240 (two years' worth of annual fees) I get a flight anywhere in North America. And having seen what friends pay to visit family on the West Coast, I know those sort of long-haul round-trip flights can easily cost close to $1000, and certainly over $500, even when you get a deal.

It's not perfect, and I acknowledge there are great credit card deals out there that give you things like cash back and gift cards at retailers that you don't have to wait two years to build up enough points to make it worthwhile to redeem. Which is why I doubt I'll renew the card for year 3, when RBC isn't offering me any free points to stay with the card.

In the meantime, it's a nice little financial experiment I've undertaken for myself. Meet me in California in 2008 if you want to tell me I've made a mistake... :)

Posted by

GIV

at

2:47 PM

3

comments

![]()

Labels: credit cards, reward programs

Monday, November 20, 2006

My first credit card

A lot gets written about the evils of credit cards, and how one of the best things someone having financial difficulties can do is to just cut up their credit cards. That may be the case for some people, but I've never really thought that applies to me.

I got my first credit card in university. It was a basic, no-fee student card. I think my initial limit was something like $500 to start with.

I remember some friends and I were planning a trip together, and the easiest way to book those sorts of things is to put it on a credit card. A friend of mine didn't have one, so she cut me a cheque, and I put her fees on my card too. The charge for the two of us combined would have put me over my limit, so I nervously called the bank to ask them if they might be kind enough, to, uh, bump up my credit limit to $2000 a month -- just this once, pretty-pretty please.

The lady on the phone was quite nice, and she briefly put me on hold while she reviewed my file. I was sweating it out on the other end, certain she was going to figure out I was only earning about $25,000 a year, eking out a frugal living in Canada's most expensive city, living with 4 roomates in a crappy student house. She was probably in the process of telling the whole office about my audacity, having a good laugh at me before coming back with a "who the hell do you think you are?" speech, I reasoned.

Little did I know.

Imagine my surprise when she came back on the line: "Certainly sir. I've reviewed your file and am pleased to tell you that not only has your credit request been approved, but I'm further authorized to offer you our platinum card with a limit of $10,000 a month."

I was stunned. It was mind-boggling to me that the bank was willing to front me 40% of my annual salary, sight unseen, every month. I'm now a lot more savvy about the way banks operate and the way they make their money, but at the time I was positively shocked at the kind of money they were throwing my way.

I ended up signing up for RBC's no-fee platinum card -- how's that for an oxymoron -- and used it diligently for 2-3 more years, never coming anywhere near that $10,000 limit. I've since upgraded cards once again and my credit limit has been once again bumped up -- still to a level I can't fathom ever approaching in any given month. But I'll never forget my shock at the way that played out. I think that's the moment my eyes were really opened up to how the financial system works.

Banks have a bad reputation with a lot of people. They get accused of trying bankrupt people, but really, having you go bankrupt is the last thing any bank wants. If I was a cynic, I'd say a bank's goal is to keep you in a manageable amount of debt for your entire life. Never deep enough to make you go under, but just enough so that they can rely on your for a constant flow of steady income in the form of debt repayments. Giving people who aren't good with money a credit card is one of the best ways they can achieve this.

I've been lucky to have parents that helped finance my education, and I know they're still behind me today, ready to bail me out if I ever go in any serious finacial problems. Happily enough, and largely thanks to the financial education they've given me, I've never been in a position where I had to use that safety net.

I think VISA has earned a total of less than $100 from me in the past 10 years, all from one month when I couldn't pay my bill off in full and had to resort to only paying the minimum balance. My interest charge was $87 the next month, and it hurt so much to pay it that I swore to myself I'd never let that happen again. I suppose $87 isn't too much to pay for nearly 10 years of convenience, plus special perks like extended warranties and travel insurance. But something inside me found it fundamentally abhorrent, so I've never done it again.

I guess what I'm saying is that for people like me who pay off their balance in full every month, having a credit card is a great, convenient way to learn about money, build up credit, and squeeze a few perks out of your bank.

But if you find yourself in any sort of debt problems, cutting up the credit cards with their 18% interest rates is a great place to start.

Posted by

GIV

at

12:12 PM

3

comments

![]()

Labels: credit cards

Friday, November 17, 2006

Things that make me go hmmm.....

'ENERGY STOCKS TAKE COMPOSITE INDEX NEAR RECORD HIGH' the teaser on the front of ROB gushed yesterday.

'TUMBLING OIL PRICE HITS ENERGY SECTOR' that same space laments this morning.

Just a gentle reminder to all of us -- don't get too carried away chasing short-term trends.

Buy. And hold.

Oh -- and stay away from oil.

:)

Posted by

GIV

at

11:31 AM

0

comments

![]()

Thursday, November 16, 2006

I'm losing my will to save

Yes, yes, I know that saving a little bit every paycheque and putting it aside for a rainy day is one of the best things I can do for myself.

And I also know that buying a house as early as possible and socking money into an RRSP in my 20's will put me in a better financial position that about 99% of my peers.

But dammit -- it's hard. I've been a good little saver this year ($7,000 into my RRSP for the year, and it's increased in value by about 15% already) and my automatic savings program diverts a good chunk of my paycheque into a high-interest savings account before I can even sniff it.

Sure, the ever-so-slowly up-moving squiggly line that represents my net worth does give me a nice little sense of accomplishment -- but my self-satisfied smugness is no match from the joy I'd derive from liquidating my Combine enemies on a brand, spanking new Xbox 360 system. Nor is it any match for, say, tossing back mojitos like Lindsay Lohan at a frat party while lounging around on the beach at one of these places, for example.

In short, I need a bit of a break. Christmas is coming up, and in addition to the myriad gifts I'm planning to give to friends and family, I think some treats for me are in order.

But don't worry, pfblogosphere. I'm sure my little anti-frugality protest will be short lived. Come January, I'll once again be waist-deep in the forests of paper that the financial press annually puts out on where to park those tax-free RRSP dollars. And I don't think the new video game console I've been jonesing for qualifies as a buy-and-hold investment.

If I don't re-discover my saving mojo, I'm sure you people will remind me of it.

I'm just sayin' -- if the diet ain't fun, you're not going to stick with it.

Posted by

GIV

at

4:55 PM

1 comments

![]()

Tuesday, November 14, 2006

Conservative investors take more risk?

Conventional wisdom has it that conservative investors are more likely to save up a solid downpayment in the neighbourhood of 25% of the value of the home before jumping into the real estate market, while riskier people are the ones who sign up for no-money-down, 35-year mortgages and the like.

But an interesting post out there in the pfblogosphere is aiming to try to turn that notion on its head.

This post makes the contention that truly conservative investors are in fact more likely to go for 0% downpayment options, where the purchase price of the home is 100% paid for by the bank.

Basically, the argument is that in 100% financing deals, the bank is the one swallowing 100% of the risk -- both that the buyer won't be able to pay off the mortgage, and that the value of the asset will depreciate.

The reality is the conservative financing option is 100% financing. You have pushed all risk to a third party -- the bank! In doing so, you remain completely liquid -- the true goal of a conservative investor.

I'm not sure I buy the argument myself (the author's job as a mortgage broker clearly gives him an agenda that colours his opinion, IMHO) but it's certainly an interesting viewpoint.

My own nature tells me the best plan is to save up a significant amount of the purchase price for a downpayment, as a hedge against some calamity happening later on -- like losing a job, having to move, or a real estate crash.

So that's what I'm doing. Apparently that makes me a risky investor. :)

Posted by

GIV

at

12:23 PM

1 comments

![]()

Labels: investing, real estate

Monday, November 06, 2006

Emptying the notebook

In the proud tradition of lazy newspaper columnists everywhere, let's hammer out a smattering of unrelated tidbits on several different personal finance topics, shall we?

Item the First -- Kudos to City Girl for hosting the Carnival of Personal Finance this week. Lots of good stuff there, as always. And, unlike always, one entry by yours truly.

One day, when I'm so inclined, I'll have a go at hosting one of these.

B -- Loyal readers (Hi mom!) will recall my ambitious plan to have a net worth of $20,000 by the end of September.

Yes, I know it's the start of November now, but I'm pleased to say that I've more than met that goal. With a little over 16K in the brokerage account and $7,000 gathering dust over at ING, my net worth currently stands at around $23,000. I don't have any schmancy graphic to commemorate the event -- maybe I'll get on that. And maybe it's time for me to set myself another short-term financial goal, since the first one went better than expected. I suspect as the holiday season approaches (already!) finding the excess funds to save is going to get a bit trickier. So I'm glad I've got this benchmark to hang my hat on for now.

iii --On the trading desk, I put in an order in today for 140 units in Claymore's new Dividend Achievers ETF. Designed to emulate the Mergent Dividend Achiever's list, Claymore Investments only launched the product in September.

I like it for a variety of reasons: it's a decent defensive play since I think the economy is starting to cool off a little bit: it gives me excellent exposure to Canada's strong financial sector (something I've been lacking) and it has a higher yield and is more diversified than it's closest competitor, iUnits' XDV. Sure, it has a slightly higher MER, but I'm confident that the ETF's focus will make up for that. Plus, I like the focus on companies with growing dividends -- not just dividends per se.

If that's not enough, Canadian Capitalist is a fan. Works for me.

Thoughts, kudos, comments and critiques are welcome as always.

Posted by

GIV

at

4:10 PM

1 comments

![]()

Friday, November 03, 2006

Berkshire Hathaway hits $100K

With a single share in Warren Buffett's company, Berkshire Hathaway, eclipsing the $100,000 mark for the first time in history recently, it seems like a good time to look at some of the world's most expensive stocks.

MSN Money has an article up which does just that.

Since I'm a Baby Berk owner myself (it's been a nice little investment already, as it's increased from $3,100 to more than $3,500 in the less than a year that I've owned it) it was interesting for me to note two things.

1 - Berkshire Hathaway really is in a class by itself

2 - The other expensive stocks come from a wild variety of sectors

Google, by the way, didn't make the top 10 list. It sits at #11.

Posted by

GIV

at

2:20 PM

0

comments

![]()

Wednesday, November 01, 2006

The 80/20 rule of personal finance

"Watch the pennies and the pounds take care of themselves," the old adage goes.

It's a theory a lot of pfbloggers hold near and dear to their hearts. And truth be told, it's not a bad axiom to live by, but a few posts out there in the blogosphere have me rethinking this sort of conventional wisdom.

Does the small stuff really add up?

I found Canadian Capitalist's candid piece on the $8,000 he spent to have an unused van parked on his driveway for a year quite compelling.

I'm paraphrasing him a little bit (and my apologizes if I'm in any way taking his views out of context or misquoting him) but essentially, CC stretches his dollars further by doing things like coupon clipping and brown-bagging lunches to work. Yet on major purchases like homes and cars, though he tries to have a similar nose for bargains, a lot of the time there's wasted money because the item either wasn't really needed in the first place, or wasn't acquired at quite the same bargain level as that 99 cent loaf of bread from the bakery on the other side of town. I think the point is, overpaying for a house or a car you arguably don't need dings your wallet a lot more than those nickel-off-toothpaste coupons can ever hope to offset.

The tone jibes very well with this older Uncommon Way to Wealth post in which the author realizes that while it's nice to mind the little stuff, the decisions that make your net worth grow by leaps and bounds are always the bigger, albeit less frequent, ones.

The inspiration for the piece is the so-called Pareto Principle -- a theory, incorrectly attributed to early 19th Century Italian mathematician Vilfredi Pareto which states that in any given experiment, 80% of the results can be attributed to 20% of the variables.

Pareto originally used the theory to explain how 20% of his country's citizens were responsible for 80% of the income earned in his country. But over the years, it's been used, abused and watered down to the point where other disciplines borrow the same 80/20 ratio for themselves.

For our purposes, I think my own Pareto Principle of personal finance goes something like this: 20% of the decisions we make involving money are responsible for 80% of of how much money we have.

I don't write this to discourage people from doing little things like cutting out expensive lattes, choosing no name products over brand names, and cutting coupons from the newspaper. Those are all great things that can add up.

I just wish people were as exhaustive about the major decisions. Do you really need that new car? Are you sure you couldn't save money by calling a mortgage broker? Maybe they could turn that 5.2% variable rate into a 5.1% variable rate.

At the end of the day, it all adds up. It's just that with the big things, it all adds up a lot faster.

Posted by

GIV

at

11:40 AM

3

comments

![]()

Tuesday, October 31, 2006

Trick, then treat

When the Tories promised, in the last election, to scrap capital gains taxes as long as the profits were reinvested within six months, people in the personal finance community were excited.

The theory was that stifling taxes on capital gains were trapping money and hindering the economy, as people held on to assets they would otherwise have sold had it not been for the fear of taking the capital gains tax hit.

I recall it was a key cog in the Tory platform, but they quickly scuttled the proposal after they were elected once they realized how unwieldy (and dare I say, expensive) it would have been to implement.

But news is out today that the proposal is apparently back on the table. Finance Minister Jim Flaherty is publicly toying with the idea of implementing some version of the proposal, possibly as early as in the 2007 Federal Budget.

I can't help but notice that this news comes as the possibility of another election is rearing its head, but still -- good news, I say. Although I must admit, so far my own portfolio is more a story of capital losses, as opposed to capital gains over the years, in the last 18 months or so, as I've gotten more serious about my investments and started to do my homework before jumping in, I'm pleased to say it looks like I have some winners on my hands.

Some day, I'm going to want to sell them. And it will be nice if I can keep as much of my gains from shrewd investing as I can -- since I'm mostly likely to plow every cent of profit I get into buying an economy-boosting home at some point.

If and when that happens, the government will get theirs. I'm still no fan of a lot of the Tories' other policies (the constant bickering over same-sex marriage and their laughable policy on protecting the environment leap to mind) but from a financial perspective I'm pretty impressed by their commitment to stimulate the economy by giving Canadians as much money in their pockets as is possible.

We'll see how this plays out.

Posted by

GIV

at

12:47 PM

0

comments

![]()

Thursday, October 26, 2006

My morning smile

Thanks to Ramit over at IWillTeachYouToBeRich.com for drawing my attention to this today:

I know people like this. They'll happily spend 15 hours a week making sure their Battlestar Galactica fansite is 100% up to date, but they don't know what an RRSP is. Or how much the interest rate on their $6,000 credit card debt is.

Posted by

GIV

at

4:29 PM

2

comments

![]()

Tuesday, October 24, 2006

CPP is A-OK

Of all the contentious debates currently simmering among the U.S. population, the question of what to do with Social Security is just about one of the most impassioned ones you can find right now.

Up here in Canada, we had our own version of this debate a few years ago, when everyone (and their elderly mother) chimed in with an opinion on when, exactly, the Canada Pension Plan was going to run out of money, and what, precisely we should do about reversing that trend.

State-run pension plans are generally thought of as being underfunded and chronically mismanaged. But in Canada's case, at least, I think that's an unfair characterization. The reality is way better that most people's perception.

Very quietly, the Liberal government in the 1990s overhauled the way CPP works, moving the plan away from low-risk, low-yield Canadian bonds and into more diverse equities from around the world.

Ten years on, the results are eye-opening. The CPP has averaged an 8.6-per-cent return over the past five years, and the chief actuary is forecasting returns of 4.6-per-cent above inflation per year over the long term.

In 2006, the plan actually showed a surplus of more than $100-billion and it's estimated there is already enough money in there to sustain itself for 75 years, even if the assets stop growing entirely.

As financial planner John DeGoey is quoted as saying in the above-linked article: "You can say what you want about Paul Martin but he did well in getting the financial house in order."

I don't write this to in any way cheerlead for the former Liberal government. But in an age where we see waste all around and too many people, and governments, not showing enough fiscal restraint, I think it's important to recognize a job well done.

Remember those numbers the next time you catch yourself griping about the CPP contribution your employer takes off your next paycheque.

Posted by

GIV

at

11:56 AM

0

comments

![]()

Friday, October 20, 2006

Nickels and dimes

"I never have any money," a friend lamented to me this week. "I don't understand why -- I earn a good salary but it all seems to be gone as soon as it comes in," he said as he paid the $1.50 service charge to take $20 out of the ATM machine to pay for his $12 movie ticket.

Thirsty after the disappointing movie, I started out on the 10-minute walk to a local pub to grab a drink when he stopped me, gesturing towards the taxicab line in the opposite direction, and telling me to get in. "It's on me," he said.

Six dollars (and 5 minutes) later, we got out and went in to find a table. Three beers later, on my walk home, I find myself thinking, once again, about his financial predicament.

"I think I know where the money goes," I think to myself.

Posted by

GIV

at

11:41 AM

0

comments

![]()

Wednesday, October 11, 2006

Fools and their money

Another day, another step toward complete financial ruin.

Not for me, of course, but two stories I read today in the daily papers have me convinced that people's zeal for real estate has them blindly making some truly baffling decisions.

First, Garry Marr of the Financial Post's story about Genworth Financial (it's behind CanWest's iron-clad subscriber wall, but you can get the gist of the story on Jonathan Chevreau's Wealthy Boomer blog here) announcing that they will be the first to offer 40-year mortgages in Canada.

Given that Genworth was also a pioneer of sorts when they unveiled 30 and 35-year mortages earlier this year, I'm not surprised that they've upped the ante to 40 years. It's to their benefit that you pay them for longer. But what truly struck me dumb is that in the article, the Genworth rep says the only reason they offered the product was because of the positive response to the previous, 35-year term: a full 20% of Genworth customers now opt for the 35-year term.

That's absolutely astounding to me. I've said it once and I'll say it again -- there's an alarming lack of understanding about the way money works in this country, and the financial services industry is profiting handsomely because of it.

I had just about recovered from the thought that people will now literally be passing their mortgages on to their children when they die, when I read more distressing real estate news in the Globe. Non-conventional, high-rate mortgages to people who don't qualify for conventional loans are increasing to the tune of 50% per year in Canada, a story by Heather Scoffield reveals. More than 85,000 people signed up for the products in 2005.

40-year mortgages? Let's put it this way. If I told you you had to keep paying me money until the Leafs win the Stanley Cup, would you sign up for that?

Didn't think so.

The bottom line is quite simple, really: If you can't afford a house, don't buy one. Don't talk yourself into thinking that paying $700,000 for a $200,000 loan over 40 years is somehow a good idea.

Posted by

GIV

at

11:57 AM

2

comments

![]()

Wednesday, October 04, 2006

Gambling on gambling

I can't lie -- this hurts.

Parlay Entertainment, a small Canadian company that eked out a position as the dominant provider of on-line bingo software, has been swept up in the misery that the entire on-line gambling sector has been wallowing in since the U.S. Congress moved last week to effectively ban gambling on the Internet for U.S. citizens.

I bought shares in Parlay about 18 months ago after being impressed by their management calibre, and the fact that they were very quietly boosting revenues and market share in a fractious market.

The company made news last month when it announced it had agreed in principle to merge with a larger competitor, Chartwell Technologies. I was still mulling over the numbers, trying to decide what I was going to do with my Chartwell shares when this gambling ban news broke.

I can't say I was totally surprised by the move -- Congress has been sabre-rattling for years about shutting down gambling outfits, and a Republican caucus has been ramping up their feigned outrage to try to garner some family-values support going into midterm elections. So I'm not surprised that the move came.

But still: seeing 50% of the value of a company I liked a lot knocked off within the span of a week didn't exactly leave me with warm and fuzzy feelings. According to the company itself, about 60% of Parlay's revenues came from US-based customers. So it makes sense that the company has shed nearly 60% of its market cap since news it woudl lose 60% of its revenues broke.

So now I'm left wondering the $64,000 question -- now what? Do I sell my shares for whatever I can get for them and put the whole sorry chapter behind me? Or do I stick it out, secure in the knowledge that this is probably just an over-reaction?

Right now I'm leaning towards the latter option. A quote from the CEO of sector-heavyweight CryptoLogic on the matter is stuck in my craw:

“Internet gaming is here to stay. The genie is out of the bottle. There are millions of players around the world who play the games responsibility,” CEO Lewis Rose said. “We believe that regulation is the best way to bring on-line gaming into the sunshine. And sunshine is the best detergent.”

At the same time, it has decided to take a non-confrontational approach with the United States in the hope of one day being able to serve that market legitimately. Mr. Rose said he is still hopeful that Congress could eventually choose to tax and regulate Internet gambling, similar to an approach adopted by Britain.

“There are clearly going to be tremendous opportunities now. There's going to be an opportunity for consolidation of the industry. And we believe the cards are in our favour at the moment.”

This view really rings true to me. It's painfully obvious that there's a market for Internet gambling, so it's not going to go away. Prohibition of alcohol didn't work and neither will this over the long term. I suspect that for the next few years, the sector will grow revenues everywhere but the United States, before the U.S. Congress ultimately wakes up to the revenue potential and opens the floodgates to take their share through taxation.

I also think he's bang on in his assessment that consolidation is coming. In that scenario (and with more than $100-million in cash on hand) I suspect Crypto will be a buyer. And Parlay will remain a seller.

But I plan on remaining a shareholder.

Posted by

GIV

at

1:24 PM

0

comments

![]()

Tuesday, October 03, 2006

The Seven Habits of Successful Investors

MoneySense magazine is one of my favourite publications and their current issue on Canada's best small investors is always one of my favourite issues of the year.

The issue profiles a handful of small investors, sharing their strategies for how they grew their meagre portfolios into six and seven-figure masterpieces in a relatively short timeframe. This year's edition isn't available on-line yet (I suggest you buy a copy) but you can have a look at last year's edition by clicking here.

In addition to an update to what's happened to last year's names, the writer of the piece, Duncan Hood, has compiled a list of the seven habits of successful investors, culled from what he's learned through interviewing them for the last few years.

They really want a million bucks

Seems simple enough.

They like to save

Definitely sounds familiar.

They start young

I bought my first mutual fund at 16 and my first stocks at 22. Does that count?

They can take huge risks

Doesn't sound like my kind of bag. I try to curb that impulse.

They can handle big losses

Well, I've had big losses, and it didn't kill me. I guess I qualify.

You can handle debt

No thanks

Your investing style suits you -- if you don't have all of these attributes, don't worry.

Phew!

Posted by

GIV

at

9:38 AM

0

comments

![]()

Monday, October 02, 2006

Every little bit helps

An interesting bit of news came in the mail for me the other day.

Back in 2003, I came upon a little sum of money when my grandfather died and left me a few thousand British pounds in his will. I splurged on a new laptop for myself (still got it) and vowed to use the rest to get my feet wet in this thing called the stock market I was hearing so much about.

I was vaguely familiar with the concept of diversification, so I resolved to put the cash, about $3000 total, into shares of two companies I'd heard of: Biovail (lots of old people means lots of demand for drugs, I reasoned) and Nortel (if they were going to go belly-up they'd have done it by now, my thoughts went).

Biovail and Nortel.

Don't be alarmed by the blood-curdling scream you just heard. That was just my reaction when I clawed my eyes out at the sight of those two words placed next to each other in my portfolio. Because those two companies have truly given Canadian investors some serious nightmares in the past few years, and I owned both of them at one point.

Biovail's still stinking up my portfolio to this day, but Nortel I gleefully rid myself of only a few months after I bought them. Strangely enough, I actually managed to turn a quick profit on Nortel -- the shares inexplicably doubled from about $5.50 when I bought them to more than $11 when I sold -- which makes the fact that apparently I'm entitled to part of a looming settlement in a class-action suit against Nortel even more humorous.

My on-line broker sent me the above-linked letter, detailing what I needed to do to get my share of the $300,000,000 Nortel has earmarked to pay for their role in misleading investors about their earnings in 2003 and 2004.

So how much can I expect? Crunching the numbers, because of the small amount of stock I bought (only 100 shares) I can expect something in the neighbourhood of a cheque for about $11, and 11 shares of Nortel, currently trading at about $2.50. All in all, it'll be something like a $30 to $40 bump for my portfolio -- not much more than the brokerage fees I'd accrue if I wanted to sell the shares. That's a bit of a downer. With a potential return like that, looks like I'll be hanging on to those Nortel shares once more to see if the firm can reclaim even a shadow of its former glory. At least I didn't have to pay for the damn things this time.

Still, I'm going to send in the forms to participate, and consider myself lucky for the opportunity. Because $600 in capital gains I no doubt pissed away at the local publican house back in the day, plus $40 and the potential for more in a class-action settlement is a damn sight more than most Canadian investors ever got out of the one-time tech darling.

Posted by

GIV

at

2:40 PM

0

comments

![]()

Tuesday, September 26, 2006

A sobering thought

I have no idea why this is the case, but...

A story up on CNN Money claims that on average, drinkers earn 10 to 14 per cent more than their teetotaling colleagues.

Specifically, the study (originally found in The Journal of Labor Research) found that those who regularly drank in social settings earned higher salaries than those who only drank at home or not at all.

The difference was apparently larger for women than men.

The obvious explanation I can think of is that social drinkers are more likely to be sociable, networking people in general (hence, more likely to get ahead in their careers due to their outgoing nature) but part of me doubts that there's a causal relationship going on here.

Isn't it just as likely that the inverse is true? Namely, that high earners are just more likely to drink, because they have more disposable income than someone who's budget is stretched and can't afford frivolities like booze.

Still, it makes you think. I think i'll organize an after-work tipple with some friends this evening. And for once, I'll have the excuse that it's actually good for my finances.

Cheers!

Posted by

GIV

at

10:06 AM

0

comments

![]()

Friday, September 22, 2006

RBC's Inaction Indirect

An e-mail from my on-line broker this morning.

To : XXXXX XXXXX

Subject : RBC Action Direct Inc. is changing its name

Date : 22 Sep 2006 23:59:59

--------------------------------------------------------------------------------

Thanks to your feedback, and in an effort to better identify our direct investing business, RBC Action Direct is changing its name to RBC Direct Investing . On October 15, 2006 the online investing site will be updated to reflect the new name.

Our new name is just one of the changes you will see in the online investing site in the coming weeks. We will be adding more tools and resources making it easier for you to stay on top of the market and make informed investment decisions.

Some of the enhancements you will see include:

An Intraday View that will show you your holdings and cash balances in real time;

The expanded Stocks tab with more Research & Tools including aggregated Canadian & US market commentary, stock comparison tools and performance chart views of equities.

Not that it hasn't been harped on before, but this latest round of complaining about the Big Banks' on-line brokerages seems to be de rigueur right now. I think the Globe's Rob Carrick got the ball rolling, and since then it's been picked up by some of my most esteemed personal finance bloggers.

The consensus? The Big Banks, as is their custom, are screwing over do-it-yourself investors with high fees and sub-par services. My own broker, RBC's Action Direct seems to be slowly waking up to these criticisms, by implementing a nominal cut in fees, offering more research tools and intraday price tracking.

It's a nice start I suppose, but it seems like a whole lot of window-dressing to me. More research is theoretically good, but given my general skepticism over analyst reports, I doubt I'll be overly swayed by having access to more of them. Good raw material in terms of numbers for my own research, though, I suppose. And I fail to see what having intra-day stock prices will do for a theoretically long-term investor like me. It's not like I'm going to start buying Tim's shares at $27.40, selling them at $27.84 a few hours later and buying them back for $27.13 at market close or something. That sort of short-term thinking would go against what I'm trying to do here.

At the end of the day, the one feature I really want to see (and that isn't a part of RBC's forthcoming changes) is an improvement in performance reporting. At the moment, all they have is rudimentary tracking of how much +/- your portfolio value has gained or lost compared to the book value of the equities since inception. I'm left to fiddling around on Excel to monitor how I'm doing on a monthly and yearly basis.

If RBC really wanted to help me out (or, indeed, convince me to shell out for some investment advice from them by showcasing my shortcomings) the greatest thing they could do would be to embed some sort of long-term performance tracking system into the home page.

And reduce the fees. That always helps. Although I'm not holding my breath on that one.

They are a bank, after all.

Posted by

GIV

at

10:52 AM

0

comments

![]()

Tuesday, September 05, 2006

Book Review: Generation Debt

I recently got my hands on Generation Debt: Why now is a terrible time to be young by U.S. journalist Anya Kamenetz.

In the book, Ms. Kamenetz goes through the myriad of financial pitfalls that face young people today. From credit cards, to student debt, to affordable housing, to the constant cycle of internships and underemployment, to total lack of employment, to the cost of children and finally marriage, the author covers them all at one point or another. The book is written from a first-person perspective of someone who's lived through a lot of it and found her way out, but the real meat of the book is in the personal anecdotes Ms. Kamenetz collected about money from hundreds of twentysomethings from all walks of life.

I wasn't surprised to learn that Ms. Kamenetz is a Yale grad because at the end of the day this book reads a little like an essay -- complete with citations and studies to quantifiably back up her contentions.

I must say I'm of two minds on the book. At first, I wasn't all that fond of it, mainly for it's somewhat whiny tone, and the way she seemed to just arbitrarily blame the greediness of baby boomers for the plight that befalls her generation.

I'm generally reluctant to buy into the "blame whoever was here before us" mentality because I think it feeds every new generation's arrogant view that it's somehow better from the one before it. Every generation intuitively seems to think that their music is the best, their technology is the most innovative, their political events are the most earth-shattering and generally, that nobody else has ever had their unique set of problems.

Frankly, I don't buy it. I have a history degree, so I'm very much aware that history is full of people who somehow think that they're mysteriously different than everyone else before them. That they're somehow immune to the mistakes that previous generations made.

All the factors she lists ring true to me of my generation, but essentially, I just found it hard to believe that other generations didn't face similar challenges and managed to overcome them en masse. They survived their financial calamities as I'm sure we will when all the hand-wringing is done. As Oz, my favourite character from my former favourite TV show, Buffy the Vampire Slayer, once remarked: "Well, we know the world didn't end, because ... check it out."

Still, the book has its moments. Her views on the consequences of giving easy credit to students are bang on -- it's a practice I think needs to be seriously curtailed. Ditto for her thought on the practice of keeping young people permanently underemployed by trapping them in the neverending internship cycle -- being a journalist, it's a cycle I know all too well.

And I also caught myself nodding in agreement with her views on marriage: namely, that financial issues have managed to pervert the marriage decision to the point where young people no longer ask "do we want to be married?" but rather "can we afford to be married?" and "do I want to hitch myself to life for someone who's shown a serious inability to deal with money?"

When I was a kid I never thought money really entered into the decision to get married. But as I age, the prospect of linking up with someone with, say, $40,000 in student loan debt and a $5,000 credit card balance actually enters into it for a lot of my generation.

In Ms. Kamenetz's defence, she does cut out the whining and offers some real practical solutions by the end of the book. I just think she overstates her case a bit. All in all, I'd say the book was well worth a read.

Posted by

GIV

at

3:32 PM

0

comments

![]()

Monday, September 04, 2006

Well, that certainly qualifies as news...

Not for most people, but for me anyway.

I meant to write about this a little earlier, but I wanted to digest the news a little bit before posting.

In the halcyon days before I cared about things like dividends, value investing, and staying in for the long haul, when all I really wanted was to get rich quick on the next big tech-stock darling, I bought a handful of shares in Parlay Entertainment, a TSX-listed on-line bingo software provider, hoping it would be my ticket to riches.

The rocket-to-the-top never really materialized for me, but I've held on to my shares mainly because the company was actually managing to consistenly post growing quarterly profits. Still, I was confused because while the findamental numbers were getting consistently better, the stock was basically languishing, even somewhat regressing.

I never really had an exit strategy for the stock, but I was just on the verge of selling the shares on the grounds that the market didn't appear to give a crap about what the company was doing, when Parlay made legitimate news last week.

Management has signed a letter of intent to merge with better-known on-line gaming company Chartwell Technologies.

The whole deal is going to a shareholders vote in October, but the gist of it is that if it goes through, I'll be the proud new owner of 0.75 Chartwell shares for every Parlay share I own -- 650 to be exact.

Chartwell's currently hovering around $2.50. A quick number crunching reveals that my initial Parlay investment would be in line for about a 25-30 % gain if I were to immediately flip my Chartwell shares for cash. Not too shabby.

I haven't really done my homework yet on Chartwell, but I'd consider holding on to the shares if i thought they had long-term potential. I'm a little concerned about the U.S. crackdown on Internet gambling, but I still need to take a closer look at their last few quarterly reports to see if i think they're a solid company in an industry going through a rough patch.

Any thoughts, Chartwell shareholders?

Posted by

GIV

at

5:08 PM

0

comments

![]()

Monday, August 28, 2006

Don't say I didn't warn you

Reading a story in today's Globe on how the current consolidation wave in the mining industry is creating a void of blue-chip Canadian resource companies has got me thinking -- why all the fuss over buying expensive companies?

"What do you expect when resource prices are where they are," George Vasic, a strategist at UBS is quoted as saying in the article. "Nobody is taking them over when copper is at 50 cents and gold is at $250."

Well pardon me, but why weren't they? I don't understand why all these companies are clamouring over each other, trying to outbid themselves on $16, $18, $20-billion nickel firms like Inco and Falconbridge, when they could have had them for a fraction of that a few years ago, back when everybody and their mother wasn't obsessed with all things base-metallic.

If buying Inco is such a "bold, strategic move" for Phelps Dodge or CVRD now, while the stock is worth nearly $80, why wasn't it a good idea in 2002 when you could have had it for $20? Aren't you supposed to try to buy the $80 company for $20, not the opposite? That's the sort of question I think the shareholders of these grab-happy miners need to ask of the management that run their companies for them. That, or face a sink-hole acquisition of Time Warner / AOL-like proportions.

What happens when Chinese demand slows by a single iota, and all of a sudden there isn't a ready-made market for all of Sudbury's dirt? It strikes me that in their zeal to drive the resources bandwagon, a lot of these firms are ignoring a fundamental tenet of investing: buy low, and sell high.

A few years down the line, I suspect they might be reminded of that.

Posted by

GIV

at

2:00 PM

0

comments

![]()

Sunday, August 20, 2006

An oldie, but a goodie.

Kudos to Ramit over at I will teach you to be rich for summing up my thoughts on why it's important for young people to get educated about money now. He sums up every single reason I could think of for why I think it's so important for twentysomethings like me to get active in their lives and in their finances as soon as possible. You're only young once. I wish I'd found it sooner so I could e-mail it to everyone I know.

It's just a great post.

Posted by

GIV

at

5:47 PM

0

comments

![]()

Friday, August 11, 2006

Turning around -- slowly

I've been a diligent little saver this summer (still a ways off my ambitious net-worth-of-$20,000-by-September pledge, but that's largely due to my existing investments tanking so impressively. But I digress. I'll formally update my progress soon.)

As such, I've amassed a tidy little sum that I've earmarked for an RRSP contribution. I had planned on throwing some cash into a stock I've had my eye on for the better part of a year now -- the horrendously battered publisher Quebecor World Inc.

I pegged it as a potential turnaround story a while back, based on some of the industry's fundamentals. It lost more than 50% of its value last year, yet still pays a dividend (albeit a slashed one) so those two factors attracted me. But something still isn't quite right to justify me jumping in.

I still think the stock has potential, but everything I've been reading and hearing about that industry lead me to believe that it hasn't quite hit bottom yet. Overcapacity is eating into revenues at a time when costs are escalating due to staffing. That's a bad mix. Not exactly a big neon "VALUE STOCK" hanging outside.

I still like the stock long term, but since I'm expecting it to drop a little more before eventually beginning its turnaround hopefully some time in late 2007, there's no rush to buy in just now.

As such, I've decided to park my money in the iShares REIT ETF, ticker symbol XRE on the TSX instead. I've wanted to get into the REIT game for a while, and since I'm not getting the "full speed ahead" sign about any given REIT over any other, I think I'm going to go with the whole bundle and play it safe.

After my initial research, Dundee and Boardwalk REITs looked appealing to me due to their focus on grabbing assets in Western Canada's burgeoning office market. But right now, I'm leaning away from putting my eggs in one basket, so I'll be putting an order in for $3000 worth of XRE early next week.

If you happen to be selling at the time, thanks for the units. Unless of course they tank, in which case I'll probably be calling you in six months, saying "hey buddy, wanna switch back?"

Posted by

GIV

at

11:53 PM

0

comments

![]()

Sunday, August 06, 2006

I still exist

I haven't dropped off the face of the earth. I'm just taking a customary summer hiatus from blogging, what with the other worthwhile things we have to do with our lives while the weather's nice.

I'll be back soon with a lot to say on a myriad of personal finance topics -- not the least of which will be the smell of death that's emanating from my Biovail shares after last week's carnage.

You've got to hand it to those guys. It's not often that the same company can be investigated by the OSC on one day, and have the stock hammered by an absolutely devastating patent ruling the next. That's just a special company.

Sometimes I think all Biovail needs is to have a pack of coyotes circling the podium, growling and slowing inching toward the speaker during every press conference they have to report their underwhelming earnings.

Posted by

GIV

at

11:08 PM

0

comments

![]()

Monday, July 03, 2006

Naughty...

Dean Pariposh, of Toronto, said he thought about buying rental properties in Calgary, but then calculated that he would be paying out more in mortgage and maintenance expenses than he was taking in from tenants. He went to Edmonton instead, bought several properties and raised the rents by 20 per cent. (There is no rent control in the province, so rents are negotiated much like any other contract.) Although there have been numerous stories in the local press about tenants suffering from sudden jumps in rent, Mr. Pariposh said none of his tenants gave notice to move out. For him, it is a confirmation of his investment strategy: Incomes are rising, so tenants can afford to pay more, and the flood of workers into the province means there is competition even for more pricey accommodations. "They can complain all they want -- there's a shortage of housing."

Just another snippet from the latest story about Alberta's booming real estate industry. Sure the seemingly instant returns are enticing. But stories like this one make you think. Makes me think, anyway.

Gee, I wonder why there's a shortage of housing in the first place?

Posted by

GIV

at

9:49 PM

0

comments

![]()

Sunday, July 02, 2006

...and nice

A lot of people say they want to donate a lot of time and money towards charitable causes they believe in in their retirement, as though socially-responsible acts are something you turn to as an ends -- rather than a means -- in your life and your investing career.

Not so. As the world looks more and more every day like it's going to hell in a handbasket, I've found myself looking for ways to give money to support causes I believe in through the ways I spend and invest my money now, as opposed to when I retire.

Some people think of this as "ethical investing" and until now, the only real way to do it was to buy so-called "ethical" mutual funds. That poses a problem for me because I find mutual funds to be a tad rigid, and I despise the fees and MERs. Plus, the capital is vulnerable during downturns, something that's not good news for people like me who try to live by Buffett's maxim of "never lose money".

In that spirit, I draw your attention to a great little investment opportunity -- one with the added benefit of allowing you to support causes that make the world a slightly better place, while making a few dollars in the process as well.

VanCity credit union sells term deposits with relatively low minimums (some are as low as $500 initial investment) where VanCity re-invests the money you deposit into co-ops, low-interest loans to entrepreneurs, and even affordable housing projects that need help to get off the ground. You can decide whether you want your money to be invested in Canada or overseas, and like a GIC, your principal is protected since VanCity is covered under CDIC.

The best part? You might assume the returns are microscopic, but the returns VanCity currently offers actually beat most of the high-interest savings accounts I've seen, even my very own 3.15% as ING (although that number is set to go up next week)

So there's a capital-protected, RRSP-eligible investment that beats inflation and gives back to the global community in a really tangible way. That's something ol' Warren himself would get behind.

Posted by

GIV

at

10:26 AM

0

comments

![]()

Thursday, June 29, 2006

Food for thought

Having read analysts reports in a professional capacity, I've certainly had cause to doubt them occasionally, as I've witnessed turkey after turkey get glowing "buy" or "hold" recommendations from allegedly independent analysts.

Having said that, I love -- LOVE -- a new feature by the Globe's personal finance columnist Rob Carrick. Using the Bloomberg database, Carrick has compiled two dream portfolios: one full of stocks that analysts love (meaning, a consensus "buy" rating) and the other comprised of stocks they by and large hate (with "sell" ratings as a whole)

What could be more fun than grading analysts' picks by tracking their performance?

The results? Although it's still early days, it's interesting to note that the "hate" portfolio has gotten out of the gate quickly, its net value up more than 2% since March 1. Ordinarily 2% would be nothing to write home about, but given the market's slide as a whole (to speak nothing of the "love" portfolio's dismal 10% slide in the same period) and admittedly, much of the discrepancy can be attributed to DOV Pharmaceutical losing 88% of its value on the "buy" side. But things like this are important to remember the next time I catch myself getting too high -- or low -- on any given stock's prospects.

At the end of the day, none of us really know what we're doing!

Posted by

GIV

at

12:27 AM

0

comments

![]()

Monday, June 26, 2006

Caveat emptor

"If you're buying a resale condo," he says, "you need to know the history. Ask for the last two years' worth of minutes from the condo meetings." Is there any hint of a special assessment to pay for building upgrades? People often sell in advance of a fee increase, knowing it's on the way. "If there are any problems in the pipeline, they will be there in excruciating detail," Gray says about the condo minutes.

The above tip is an excerpt from a very interesting Ellen Roseman personal finance column in the Toronto Star today.

Not that I'm anywhere near being a condo buyer. But I would never in a million years think of reading the condo board meeting's minutes in making my decision. Just one more buyer beware tip for anyone thinking of taking the plunge.

Posted by

GIV

at

11:24 PM

0

comments

![]()

Tuesday, June 20, 2006

Thoughts on RIM stock option news

Not that I was even contemplating buying them (a P/E ratio near 35 doesn't sound like value to me) but I did take notice today of news that RIM's co-CEOs recently cashed in a whack of stock options worth some $76-million.

Perhaps I shouldn't read too much into it. Executives, they say, buy shares in their company only because they think the price is going up, but they may sell them for a multitude of other reasons. So maybe I shouldn't take this as a sign that the RIM boys don't see much upside to their firm's growth prospects.

But still. It seemed noteworthy.

Posted by

GIV

at

8:16 PM

0

comments

![]()

Saturday, June 10, 2006

Up and down

Bit of an up and down week for me in the ol' personal finance department. (Incidentally, I apologize for the lack of posting. Rather than some clicheed "I promise to post more, readers" vow, all I can say is my laptop died so I haven't had non-work related internet access in over a week. It should be fixed tomorrow. Sorry.)

UP - A pleasant surprise was that my tax return came in even higher than I was expecting. Despite my best efforts at accounting, I made a few snafus on my return, and as it turns out they worked in my favour. The extra grand that the federal government kindly gave me should come in handy considering the other side of my personal finance coin. Namely...

DOWN - What else? The stock market. Although my miniature diversification strategy has protected me a little in that not all of my investments have tanked by as much as my iShares international equity ETF has tanked for the past few weeks, I'm still hurting. I plan on sitting down and updating my net worth in the near future, to see how far away from my goal of $20,000 by the end of September I am. But off the top of my head? I'd guess I'm down at least $500 to $1000 in the last three weeks.

Ouch.

Posted by

GIV

at

12:23 AM

0

comments

![]()

Tuesday, May 30, 2006

You know you're in trouble when those guys are the voice of reason.

Under the latest measures, developers are required to charge down payments of at least 30 percent, up from the previous minimum of 20 percent, according to the announcement.

Finally! A sensible policy to cool the heated housing market a little, coming from the mouth of a government official.

Too bad it's not anybody at the CMHC, but rather a member of the Chinese cabinet speaking.

My tongue is firmly in my cheek on this one, but I offer it up to elicit a chuckle out of anyone my age who's wondering how they're ever supposed to afford a house in this market.

Posted by

GIV

at

12:29 AM

0

comments

![]()

Sunday, May 28, 2006

Pop quiz: who's the biggest credit card company?

It's rare that I'm shocked by anything in the newspaper these days, but I really was struck dumb by something I read in a sidebar in one of the stories on Mastercard's recent IPO.